low cost auto affordable insurance company low cost auto

low cost auto affordable insurance company low cost auto

Having a serious infraction like a DUI on your electric motor lorry record might raise your car insurance coverage premium by 88% on standard. Teen male vehicle drivers may pay $807 even more for vehicle insurance coverage on average compared to teen women drivers.

The table listed below displays the average yearly and also month-to-month costs for some of the biggest car insurance policy business in the nation by market share. We've additionally calculated a Bankrate Score on a range of 0. affordable.

low cost auto insurance vans cheap insurance

low cost auto insurance vans cheap insurance

Note that your age will not influence your costs if you live in Hawaii or Massachusetts, as state laws restrict automobile insurers from making use of age as a score element. In addition, sex effects your costs in the majority of states.

Being associated with an at-fault accident will have a result on your auto insurance. The amount of time it will certainly remain on your driving record depends upon the intensity of the mishap and state laws. As one of one of the most significant driving incidents, getting a DUI conviction commonly enhances your cars and truck insurance coverage costs greater than an at-fault mishap or speeding ticket.

How a lot does cars and truck insurance coverage expense by credit rating? This suggests that, in basic, the much better your credit scores rating, the reduced your premium - cheaper auto insurance., not a credit rating.

Car Rental Additional Driver Info - Alamo Rent A Car for Beginners

These shared features can include: The high price tag of these vehicles typically come with expensive parts and specialized knowledge to fix in the occasion of a case.

Insurance holders that drive less miles a year often get approved for reduced rates (although this gas mileage designation varies by company). Just how to discover the finest automobile insurance coverage prices, Purchasing cars and truck insurance coverage does not need to suggest costing a fortune; there are methods to save. Discount rates are one of the very best means to decrease your premium. cheapest car insurance.

Here are some of the most typical insurance policy discounts in the U.S. Drivers that have no vehicle cases on their document for the previous several years normally get savings. You can usually decrease your vehicle insurance policy premium when you pack your car insurance plan with a residence insurance plan or an additional sort of policy offered by your insurance provider, earning price cuts on both policies. For this reason, insurance coverage specialists may suggest thinking about full coverage vehicle insurance coverage Click here for more depending upon what vehicles you are guaranteeing and what possessions you have in your name. For example, if your vehicle is financed or rented, it's most likely that you will have to lug full protection on your automobile. Full coverage typically describes greater responsibility limits as well as even more coverage choices, like collision and also thorough, to cover your lorry's damages.

Having this extra coverage does indicate that your auto insurance may be much more pricey than if you were just lugging the minimal obligation restrictions, however the advantage is that it may reduce your out-of-pocket prices in the occasion of a crash.

Insurance companies file brand-new rates with the departments of insurance coverage in the states they serve yearly, so your costs may undergo increases or lowers that mirror these brand-new prices. Technique, Bankrate utilizes Quadrant Information Provider to assess 2022 rates for all postal code as well as service providers in all 50 states as well as Washington, D.C. cheap car.

Is There A Fee For An Additional Driver? - National Car Rental Fundamentals Explained

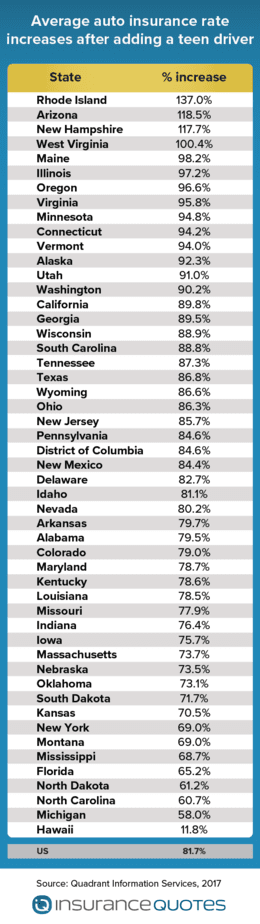

How much does your insurance rise after including a teen is an inquiry we get constantly. If you're a parent of a teenage chauffeur then you recognize it's costly! We're mosting likely to discuss how expensive it is and also provide some pointers on just how to reduce your auto insurance premium for young adolescent vehicle drivers.

Allow's talk concerning why it costs so much and also what you can do to assist decrease the amount of vehicle insurance policy you pay for your young adolescent driver. 21 is the age where prices will begin to drop.

cheaper insurance perks suvs

cheaper insurance perks suvs

How Much Does It Expense To Add a 16 Year Old To Cars And Truck Insurance? As mentioned above, it can cost a great deal of cash to include your 16 year old to your car insurance.

Take benefit of the few discount rates readily available to young chauffeurs. This discount is not readily available with as many insurance coverage firms as it used to be. It can still be a large discount rate and also it's still an useful course for your young motorist to take.

Just How Much Is Automobile Insurance Coverage For a 17 Year Old? While it holds true that car insurance policy for a 17 years of age is extremely costly, it's not nearly as bad as a 16 years of age with no driving experience! As you grow older each year your automobile insurance policy costs will continue to go down.

The Ultimate Guide To Automobile Insurance Guide

There is a distinction in expense in between male and female chauffeurs. Allow's take an appearance. Just How Much Is Automobile Insurance Policy For a 17 Year Old Women? Youthful women chauffeurs will cost much less to insure than 17 year old man's. A lot of every type of insurance policy sets their rates based off of data.

If a certain threat is less, then the rates for that insurance coverage will certainly be less - cheapest. When it pertains to 17 year old females, the information shows that they are much better vehicle drivers than 17 year old men. Women have a tendency to enter much less mishaps as well as often tend to obtain less tickets.

Male vehicle drivers, particularly young male vehicle drivers, often tend to have higher prices for car insurance coverage. Insurance business know they will certainly most likely end up paying out cash for the accident the 17 year old man is going to have, so they bill greater rates - cars.

They can often have excellent prices for 16 year olds, yet they can also sometimes have negative prices for vehicle insurance coverage. Somebody who can look at lots of different firms as well as discover the finest rate for your 16 year old.

Yes, you need to include all vehicle drivers of your lorries to your vehicle insurance policy. There is a bad rumor out there where a whole lot of representatives are specifying that you do not require to add young chauffeurs to your car insurance coverage plan.

The Ultimate Guide To Should I Add A Driver To My Car Insurance? - Progressive

This is completely incorrect as well as these agents are setting up these people to have a dreadful case experience where things are covered. Permissive use is for those people that would certainly drive your automobile that do NOT stay in your residence as well as do not drive your lorry on a normal basis.

Oftentimes, if a teen chauffeur collisions your car and they are not detailed on your plan as a motorist then there would not be insurance coverage! Should My Teen Get Their Own Insurance Plan? No, your teenage vehicle driver needs to not get their very own insurance coverage. They must be insured under your plan (risks).

Not just is it a lot more expense efficient to add your teenager to your auto insurance coverage however it also guarantees you have the proper protection. Getting your young adult their own auto insurance coverage while they are staying in your residence produces all kinds of insurance coverage problems that may influence you at the time of a case - affordable.

laws cheapest car insurance insurance companies liability

laws cheapest car insurance insurance companies liability

Some business want specific sorts of policies but do not want other kinds of policies (vehicle insurance). Some insurance policy companies will certainly have actually great pricing for teen vehicle drivers, since they desire that kind of organization whereas other cars and truck insurance policy business will have truly high rates on teenage motorists since that type of policy is not what they desire.

To examine rates with an independent agent, click right here - insure.

Frequently Asked Questions About Auto Insurance Can Be Fun For Everyone

Including an experienced motorist with a tidy record to your car insurance coverage typically will not cost you even more cash. If you add a driver to your plan that has current accidents or web traffic infractions, the insurance coverage company may charge you extra. Just how much a lot more will rely on exactly how high-risk the insurance provider considers the extra vehicle driver to be.

If you are a moms and dad as well as you add your young vehicle driver to your policy, it will likely set you back even more to guarantee him or her on your plan. Teens and also young motorists, normally under age 26, are thought about risky motorists by insurance provider, so they pay greater rates than various other age teams - car.

You can add a vehicle driver to your plan at any type of time by calling your insurance policy business as well as giving the info. That suggests he or she is covered by your policy as a periodic chauffeur, but you will certainly be the main motorist, or the one who drives the vehicle many of the time.