automobile cheap car insurance money car

automobile cheap car insurance money car

Most of these policies will also cover the personal use of your lorries, as well as those risky void times when you are on the clock yet still not covered - insurers. If you are a rideshare driver, rideshare insurance is for you.

Prices for rideshare insurance coverage policies can differ significantly from service provider to supplier and also will certainly depend on an array of personal elements like credit rating rating, driving background, as well as location. Keeping that in mind, a rideshare insurance plan may set you back as low as $10 a month to upwards of double the expense of a basic personal vehicle insurance plan (auto).

"I can't get over exactly how easy the procedure of looking for even more economical insurance was with Jerry! I have a clean driving record as well as could not recognize why my insurance coverage expenses kept going up.

auto money prices auto

auto money prices auto

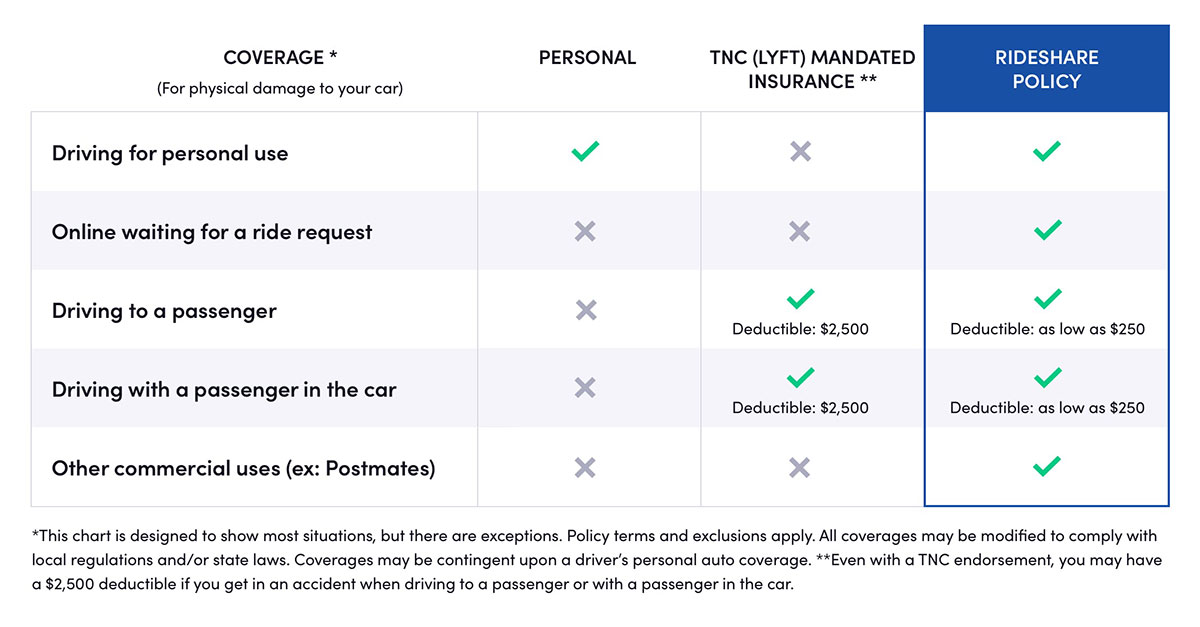

Neither the rideshare business insurance plan neither your typical plan will fully cover you during the period where you are on the work yet haven't yet approved a flight or distribution demand. Also if you are associated with a crash in among the periods that is fully covered by the common Uber or Lyft business insurance plan and also you require to sue, you will likely be in charge of paying a $2500 deductible. insurance.

Uber as well as Lyft insurance by period When it comes to Uber or Lyft, the business insurance coverage either kicks in or Go here does not begin according to a designated period of the ride that you are in the procedure of finishing. The system works as complies with: This period covers any type of time when the rideshare application is not turned on. insure.

Fascination About Rideshare Insurance For Uber And Lyft Drivers - Forbes

This duration describes the details time duration where your application is activated but you are still waiting for or haven't yet accepted a customer request - auto. This is the void duration where you are not covered by your conventional individual insurance plan or the rideshare app policy. If your firm insurance coverage offers coverage at this factor, it will certainly be very limited.

Once you accept a ride request and go out towards your set destination, your rideshare business insurance plan will fully enter into impact. low cost auto. As soon as you get a guest and also have them in your auto, you are still fully covered by your rideshare company's insurance policy bundle till the ride is marked complete.

insurance affordable liability vans automobile

insurance affordable liability vans automobile

This is where rideshare insurance covers the spaces. vehicle. You will be covered by the very same regularly solid policy despite whether you get on or off the task at any type of particular time. Shipment service insurance policy by period If you are driving for a delivery app service, it is essential that you spend some time to have a look at your business car insurance policy to figure out specifically what you are covered for and also what isn't covered.

During this period, you will certainly be covered by your personal insurance plan. This period describes the particular amount of time where your app is turned on however you are still waiting for or have not yet approved a shipment request. cheaper cars. Throughout this space period, you could not be covered by either your conventional individual insurance plan or the shipment application's plan.

low cost auto insure trucks insurance

low cost auto insure trucks insurance

Numerous motorists will require a supplementary rideshare insurance coverage plan to ensure they are covered during this in-between duration. Unlike Uber or Lyft, not all distribution app firms will certainly provide you with firm insurance when you are driving to grab a distribution but have not gotten the product yet. Sometimes, when you accept a request as well as head out towards your set location, your delivery application company insurance coverage plan will fully or partially entered into impact. insured car.

What Does Rideshare Insurance - Get A Free Quote Mean?

If your company does not offer insurance coverage, you will be left vulnerable need to you be entailed in a crash while providing a product. As you can see from above, many delivery app chauffeurs can possibly be left without insurance at any kind of period of the procedure. At other times, you might only receive minimal insurance coverage by your company insurance policy if at all.

accident suvs liability trucks

accident suvs liability trucks

State Ranch rideshare insurance coverage is offered in almost every state (with a few exceptions) and does not included any type of pesky strings like mileage restrictions connected - cheapest car insurance. If you work for both a rideshare service as well as distribution application service like Uber, Eats, you can expand your insurance coverage without having to fret about paying a greater premium.

The Allstate rideshare insurance coverage policy operates as an add-on to an existing personal automobile insurance coverage. insured car. Generally, ought to you be associated with a crash while in any one of the durations covered by your rideshare business policy, the individual rideshare add-on will certainly help you cover the distinction between the business insurance deductible as well as Allstate's much reduced typical deductible of about $500.

On the drawback, you have to have an existing Allstate vehicle insurance plan in position in order to subscribe as well as Allstate does not ensure that you will certainly be covered when you get on the job, so you still may be left susceptible throughout the void periods while functioning (cheaper auto insurance). Progressive's rideshare insurance policy protection, The noteworthy feature of Progressive's rideshare insurance bundle is that it is one of one of the most personalized rideshare insurance coverage prepares available.

For instance, they represent "on" and also "off" periods of the year while appreciating the comfort of recognizing that you will be covered year round without overpaying for your coverage. The disadvantage to the Dynamic rideshare strategy is that the rates system is not very clear and also it is very customized, making it tough to accurately value out options when you compare economical auto insurance quotes.

Car Insurance For Uber And Lyft Drivers for Beginners

It is an excellent idea to have the following documents on hand ought to they be called for: Any kind of relevant Rideshare business certification, A duplicate of the Rideshare company policies, Proof of your personal insurance policy, While awaiting the cops to show up, preferably, exchange any type of relevant info with the various other motorist. This ought to include the following: Legal name, Get in touch with information, Insurance information, Call your individual insurance carrier as quickly as possible (low cost auto).

Rideshare insurance policy has come to be significantly popular recently with the evolution of firms like Uber and also Lyft. If you're helping a rideshare business, you'll require unique defense that isn't covered under your standard individual auto plan. Discover how rideshare functions as well as what you can do to see to it you have the best protection for your vehicle.

The bright side is that you would not require a different personal automobile policy because a for-hire livery plan can cover you for both company and individual usage. credit. We supply for-hire livery insurance in 38 states. Extra Info.

Your individual insurance provider can refute your insurance claim or drop you as a client if you lie about using your cars and truck to make deliveries. You might even be billed with insurance scams. On top of that, shipment companies deal with drivers as independent professionals, so they do not have to supply substantial insurance policy protection, either.

If you depend on a delivery company's insurance coverage, you will certainly not have coverage for yourself or your car while you are waiting for an order demand. As well as for companies like Instacart and Grubhub, the company does not offer insurance policy protection for any factor while doing so. It is also essential to note your personal automobile insurance policy will not offer coverage while your distribution application is on, whether you are waiting for a demand or actively grabbing or providing.

What Does Get A Quote For California And Illinois Rideshare Insurance Do?

That means State Ranch clients who drive for delivery solutions can miss the included expense of a business policy or rideshare add-on. If you do not have a policy with State Farm and don't wish to switch over, the following best way to obtain shipment insurance protection is by purchasing a rideshare Add-on that covers shipment driving (credit).

If you drive for Instacart or Grubhub, be sure to acquire a plan that will cover you regardless of whether you have food in the auto - vehicle insurance. Business policies are usually more costly, but it's far better to pay added for the appropriate protection than to deal with the monetary effects of a crash that is not covered by your insurance coverage.

This is considered the "space" in coverage since you technically do not have any kind of during this time. Consider these stages: You're covered by your personal auto insurance plan - cheapest. You're not covered by your individual automobile plan, as well as you have actually limited protection under your rideshare firm's insurance policy. * You're covered by your rideshare business's insurance coverage.